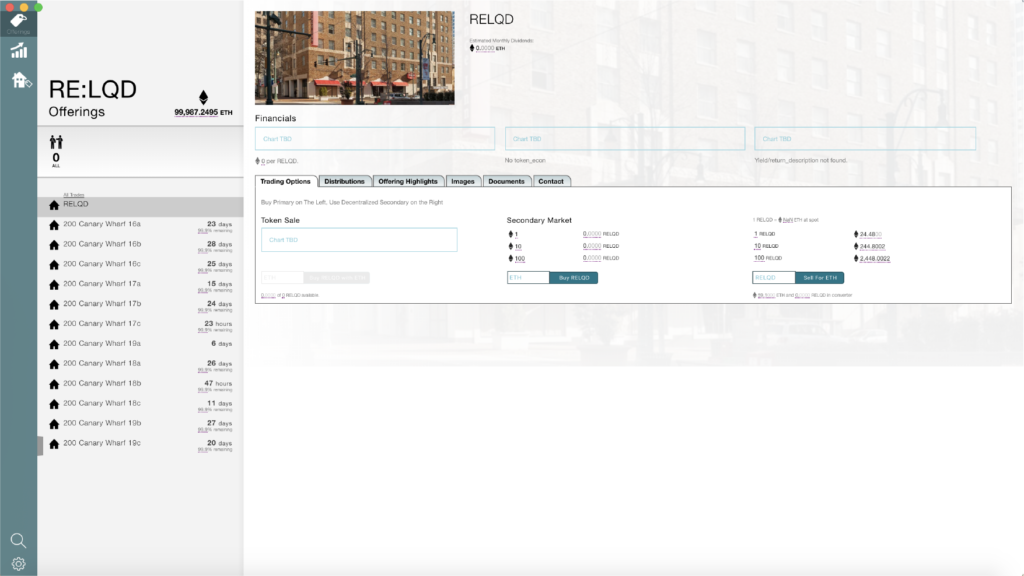

Why Tokenization?

01 Case Study for Real Estate Fractionalized Ownership

● Associating assets with a token creates liquidity for investors without needing sale of entire property

● Model can be similar to close-end fund, collectible asset is sold at point in time in future and token holders are compensated for their stake.

● Model can be similar to close-end fund, collectible asset is sold at point in time in future and token holders are compensated for their stake.

02 Asset Interoperability

● Investors can own smaller units of value allowing diversification in assets (e.g. time period/neighborhood), insulate against trends/downturns in real estate market

03 Liquidity Premium

● Increased liquidity and market depth due to asset digitalization allows for immediate value increase of property.